One of the major things that has been driving optimism among analysts is Cisco's commitment to the "Internet of everything," an encompassing business concept that would provide it with massive opportunities in the networking solutions segment. Unarguably, Cisco has robust fundamentals that could generate sustainable growth in the long run, but is the company good enough to give credible short-term returns? Let us see.

The old guard is struggling to revive growth in its age-old performing segments that include switching and routing equipment. While CEO John Chambers has shown excessive optimism in the new "Internet of Everything" concept, investors are still in confusion over the actual potential of the business idea and the way that Cisco is going to leverage this opportunity. Besides the mentioned skepticism, analysts and investors are cognizant of the threat posed by Software Defined Networking (SDN).

Is SDN a Looming Threat?

I have no intent of going deep into discussing the features and future of SDN, but a little understanding of this idea that started as a research project would help in understanding the dynamics of the networking industry. Basically, the aim of SDN is to simplify networking programmability and to achieve a holistic management of network configuration. Earlier, experts equated SDN to OpenFlow, a communications protocol that was essentially used to manage low-level packet flows using a centralized controller. But of late, it has been realized that SDN is an expansive concept and it should be adopted to ensure easy use of networks and reduction in operating costs.

Cisco Is Getting Ready to Combat the Threat

Though the potential of SDN controllers has not been fully established yet, the catch is that enterprises are looking at options to reduce their operating expenses and get collaborative networking solutions. Cisco has hitherto been a seller of individual networking components, and its decentralized architecture has not promoted a smooth alliance of several of its products. Now, under the threat of SDN, Cisco has adopted a novel and simplistic marketing model. Instead of selling individual elements, it is pitching these as a bundle of software and services called as Cisco ONE essentials.

Thus, if SDN is poised to be the disruptive technology that could change the way enterprises manage their IT systems, then Cisco has the resources to take advantage of this novel idea. Being the behemoth it is, the only thing Cisco needs to do is change the packaging of its products and move to a solutions provider label so as to provide its clients with full-fledged systems for maintenance of IT. If Cisco can successfully manage this transition, then it can easily leverage this opportunity.

Has Cisco Been Wrongfully Downgraded?

Barclays recently downgraded Cisco to a price target of $23, stating the uneven demand trends and lack of performance enhancers as a reason. Other analysts have also adopted a similar stance, and it is justifiable to a certain extent considering the past history of the stock. The stock price has stagnated over the past few months, as investors are unable to see a big clincher that could change the fortunes of the company.

These downgrades suggest that there are certain downsides to the company, and to an extent, it is true. Cisco is unarguably the leader in its space, but the growth in the past few years has been really dismal. And for a company that has hardly any competitors in its operating space, it indicates poor performance standards. Additionally, the buybacks and dividends are being used to disguise the low growth rate in the company's business and to push the yield to a comparable level with the S&P index.

Final Thoughts

In my view, Cisco needs to redesign and revamp certain components like the structure of the company, product design, and above all, its expertise in providing solutions to its clients. As I mentioned earlier, the company lacks a collaborative structure that could foster building of streamlined solutions, which has pushed clients to look for scope in SDN. Though Cisco has realized its shortcomings and has started working on it, it still needs to increase the pace of transition.

In conclusion, I would reiterate the fact that Cisco is a good buy for the long run, because it has huge scope in networking, and also, it is available at a cheap valuation. At a P/E of around 11x and a yield of around 3.5%, the company is definitely undervalued and represents an entry-point. However, if you have a shorter horizon, then I would not recommend a position in the stock for these reasons:

1.The company is still in a transition phase, and it would take considerable time to capitalize on opportunities presented by "Internet of everything" and SDN. As such, the market also will require time to regain confidence in the stock.

2. Keeping aside the future opportunities, Cisco's current numbers are not looking so good. Sequential growth in the company's essential business units is declining.

3. Cisco's management lacks the agility to take quick decisions that could enhance Cisco's basket of offerings. For instance, top management is more inclined towards combating the threat of SDN, rather than utilizing its existing resources and turning it into an opportunity.

| Currently 0.00/512345 Rating: 0.0/5 (0 votes) |

More GuruFocus Links

| Latest Guru Picks | Value Strategies |

| Warren Buffett Portfolio | Ben Graham Net-Net |

| Real Time Picks | Buffett-Munger Screener |

| Aggregated Portfolio | Undervalued Predictable |

| ETFs, Options | Low P/S Companies |

| Insider Trends | 10-Year Financials |

| 52-Week Lows | Interactive Charts |

| Model Portfolios | DCF Calculator |

| RSS Feed | Monthly Newsletters |

| The All-In-One Screener | Portfolio Tracking Tool |

| Latest Guru Picks | Value Strategies |

| Warren Buffett Portfolio | Ben Graham Net-Net |

| Real Time Picks | Buffett-Munger Screener |

| Aggregated Portfolio | Undervalued Predictable |

| ETFs, Options | Low P/S Companies |

| Insider Trends | 10-Year Financials |

| 52-Week Lows | Interactive Charts |

| Model Portfolios | DCF Calculator |

| RSS Feed | Monthly Newsletters |

| The All-In-One Screener | Portfolio Tracking Tool |

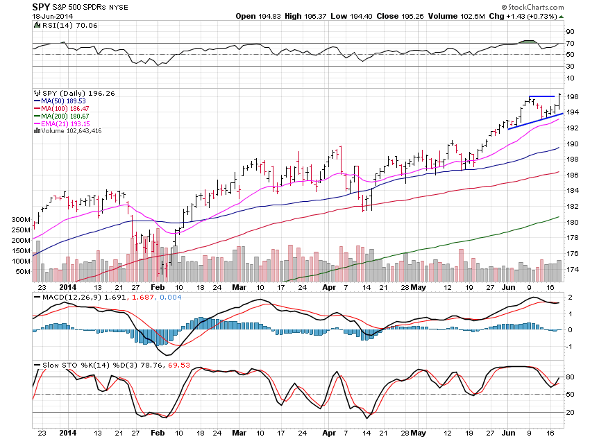

SPY is now breaking out of the wedge pattern and off to the races. Nice volume pushed it to the breakout point which is what I always like to see.

SPY is now breaking out of the wedge pattern and off to the races. Nice volume pushed it to the breakout point which is what I always like to see.