One of the major things that has been driving optimism among analysts is Cisco's commitment to the "Internet of everything," an encompassing business concept that would provide it with massive opportunities in the networking solutions segment. Unarguably, Cisco has robust fundamentals that could generate sustainable growth in the long run, but is the company good enough to give credible short-term returns? Let us see.

The old guard is struggling to revive growth in its age-old performing segments that include switching and routing equipment. While CEO John Chambers has shown excessive optimism in the new "Internet of Everything" concept, investors are still in confusion over the actual potential of the business idea and the way that Cisco is going to leverage this opportunity. Besides the mentioned skepticism, analysts and investors are cognizant of the threat posed by Software Defined Networking (SDN).

Is SDN a Looming Threat?

I have no intent of going deep into discussing the features and future of SDN, but a little understanding of this idea that started as a research project would help in understanding the dynamics of the networking industry. Basically, the aim of SDN is to simplify networking programmability and to achieve a holistic management of network configuration. Earlier, experts equated SDN to OpenFlow, a communications protocol that was essentially used to manage low-level packet flows using a centralized controller. But of late, it has been realized that SDN is an expansive concept and it should be adopted to ensure easy use of networks and reduction in operating costs.

Cisco Is Getting Ready to Combat the Threat

Though the potential of SDN controllers has not been fully established yet, the catch is that enterprises are looking at options to reduce their operating expenses and get collaborative networking solutions. Cisco has hitherto been a seller of individual networking components, and its decentralized architecture has not promoted a smooth alliance of several of its products. Now, under the threat of SDN, Cisco has adopted a novel and simplistic marketing model. Instead of selling individual elements, it is pitching these as a bundle of software and services called as Cisco ONE essentials.

Thus, if SDN is poised to be the disruptive technology that could change the way enterprises manage their IT systems, then Cisco has the resources to take advantage of this novel idea. Being the behemoth it is, the only thing Cisco needs to do is change the packaging of its products and move to a solutions provider label so as to provide its clients with full-fledged systems for maintenance of IT. If Cisco can successfully manage this transition, then it can easily leverage this opportunity.

Has Cisco Been Wrongfully Downgraded?

Barclays recently downgraded Cisco to a price target of $23, stating the uneven demand trends and lack of performance enhancers as a reason. Other analysts have also adopted a similar stance, and it is justifiable to a certain extent considering the past history of the stock. The stock price has stagnated over the past few months, as investors are unable to see a big clincher that could change the fortunes of the company.

These downgrades suggest that there are certain downsides to the company, and to an extent, it is true. Cisco is unarguably the leader in its space, but the growth in the past few years has been really dismal. And for a company that has hardly any competitors in its operating space, it indicates poor performance standards. Additionally, the buybacks and dividends are being used to disguise the low growth rate in the company's business and to push the yield to a comparable level with the S&P index.

Final Thoughts

In my view, Cisco needs to redesign and revamp certain components like the structure of the company, product design, and above all, its expertise in providing solutions to its clients. As I mentioned earlier, the company lacks a collaborative structure that could foster building of streamlined solutions, which has pushed clients to look for scope in SDN. Though Cisco has realized its shortcomings and has started working on it, it still needs to increase the pace of transition.

In conclusion, I would reiterate the fact that Cisco is a good buy for the long run, because it has huge scope in networking, and also, it is available at a cheap valuation. At a P/E of around 11x and a yield of around 3.5%, the company is definitely undervalued and represents an entry-point. However, if you have a shorter horizon, then I would not recommend a position in the stock for these reasons:

1.The company is still in a transition phase, and it would take considerable time to capitalize on opportunities presented by "Internet of everything" and SDN. As such, the market also will require time to regain confidence in the stock.

2. Keeping aside the future opportunities, Cisco's current numbers are not looking so good. Sequential growth in the company's essential business units is declining.

3. Cisco's management lacks the agility to take quick decisions that could enhance Cisco's basket of offerings. For instance, top management is more inclined towards combating the threat of SDN, rather than utilizing its existing resources and turning it into an opportunity.

| Currently 0.00/512345 Rating: 0.0/5 (0 votes) |

More GuruFocus Links

| Latest Guru Picks | Value Strategies |

| Warren Buffett Portfolio | Ben Graham Net-Net |

| Real Time Picks | Buffett-Munger Screener |

| Aggregated Portfolio | Undervalued Predictable |

| ETFs, Options | Low P/S Companies |

| Insider Trends | 10-Year Financials |

| 52-Week Lows | Interactive Charts |

| Model Portfolios | DCF Calculator |

RSS Feed  | Monthly Newsletters |

| The All-In-One Screener | Portfolio Tracking Tool |

MORE GURUFOCUS LINKS

MORE GURUFOCUS LINKS | Latest Guru Picks | Value Strategies |

| Warren Buffett Portfolio | Ben Graham Net-Net |

| Real Time Picks | Buffett-Munger Screener |

| Aggregated Portfolio | Undervalued Predictable |

| ETFs, Options | Low P/S Companies |

| Insider Trends | 10-Year Financials |

| 52-Week Lows | Interactive Charts |

| Model Portfolios | DCF Calculator |

RSS Feed  | Monthly Newsletters |

| The All-In-One Screener | Portfolio Tracking Tool |

24.7 (1y: +1%) $(function(){var seriesOptions=[],yAxisOptions=[],name='CSCO',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1372654800000,24.335],[1372741200000,24.32],[1372827600000,24.59],[1373000400000,24.57],[1373259600000,24.625],[1373346000000,25.155],[1373432400000,25.41],[1373518800000,25.87],[1373605200000,25.94],[1373864400000,25.93],[1373950800000,25.71],[1374037200000,25.72],[1374123600000,25.86],[1374210000000,25.82],[1374469200000,25.72],[1374555600000,25.56],[1374642000000,25.59],[1374728400000,25.5],[1374814800000,25.496],[1375074000000,25.33],[1375160400000,25.67],[1375246800000,25.59],[1375333200000,25.891],[1375419600000,26.19],[1375678800000,26.31],[1375765200000,26.21],[1375851600000,26.12],[1375938000000,26.26],[1376024400000,26.053],[1376283600000,26.34],[1376370000000,26.321],[1376456400000,26.377],[1376542800000,24.485],[1376629200000,24.27],[1376888400000,24.27],[1376974800000,24.32],[1377061200000,24.07],[1377147600000,24.01],[1377234000000,23.86],[1377493200000,23.83],[1377579600000,23.485],[1377666000000,23.445],[1377752400000,23.45],[1377838800000,23.31],[1378184400000,23.48],[1378270800000,23.77],[1378357200000,23.69],[1378443600000,23.55],[1378702800000,23.92],[1378789200000,24.155],[1378875600000,24.375],[1378962000000,24.29],[1379048400000,24.32],[1379307600000,24.38],[1379394000000,24.37],[1379480400000,24.795],[1379566800000,24.615],[1379653200000,24.51],[1379912400000,24.275],[1379998800000,24.14],[1380085200000,24.43],[1380171600000,23.77],[1380258000000,23.33],[1380517200000,23.431],[1380603600000,23.24],[1380690000000,23.32],[1380776400000,23.005],[1380862800000,23.02],[1381122000000,22.89],[1381208400000,22.635],[1381294800000,22.5],[1381381200000,23.01],[1381467600000,23.28],[1381726800000,23.34],[1381813200000,23.18],[1381899600000,22.995],[1381986000000,22.781],[1382072400000,22.961],[1382331600000,22.93],[1382418000000,22.65],[1382504400000,22.255],[1382590800000,22.375],[1382677200000,22.455],[1382936400000,22.55],[1383022800000,22.825],[1383109200000,! 22.705],[1383195600000,22.56],[1383282000000,22.565],[1383544800000,22.58],[1383631200000,23.065],[1383717600000,23.28],[1383804000000,23.11],[1383890400000,23.51],[1384149600000,23.445],[1384236000000,23.73],[1384322400000,23.995],[1384408800000,21.365],[1384495200000,21.535],[1384754400000,21.29],[1384840800000,21.42],[1384927200000,21.23],[1385013600000,21.47],[1385100000000,21.46],[1385359200000,21.27],[1385445600000,21.21],[1385532000000,21.27],[1385704800000,21.25],[1385964000000,21.09],[1386050400000,21.26],[1386136800000,21.249],[1386223200000,20.91],[1386309600000,21.28],[1386568800000,21.22],[1386655200000,21.21],[1386741600000,20.88],[1386828000000,20.51],[1386914400000,20.24],[1387173600000,20.68],[1387260000000,20.92],[1387346400000,21],[1387432800000,21.07],[1387519200000,21.13],[1387778400000,21.57],[1387864800000,21.69],[1388037600000,21.8],[1388124000000,22.02],[1388383200000,22.25],[1388469600000,22.43],[1388642400000,22],[1388728800000,21.98],[1388988000000,22.01],[1389074400000,22.31],[1389160800000,22.293],[1389247200000,22.09],[1389333600000,22.22],[1389592800000,22.19],[1389679200000,22.41],[1389765600000,22.78],[1389852000000,22.78],[1389938400000,22.74],[1390284000000,22.83],[1390370400000,22.84],[1390456800000,22.56],[1390543200000,22.2],[1390802400000,22],[1390888800000,21.75],[1390975200000,21.65],[1391061600000,21.976],[1391148000000,21.91],[1391407200000,21.55],[1391493600000,21.8],[1391580000000,21.98],[1391666400000,22.49],[1391752800000,22.67],[1392012000000,22.83],[1392098400000,22.71],[1392184800000,22.85],[1392271200000,22.27],[1392357600000,22.56],[1392703200000,22.41],[1392789600000,22.28],[1392876000000,22.3],[1392962400000,22.13],[1393221600000,22.12],[1393308000000,21.84],[1393394400000,21.93],[1393480800000,21.92],[1393567200000,21.8],[1393826400000,21.57],[1393912800000,21.82],[1393999200000,21.87],[1394085600000,21.82],[1394172000000,21.73],[1394427600000,21.69],[1394514000000,21.61],[1394600400000,21.82],[1394686800000,21.52],[1394773200000,21.35],[1395032400! 000,21.51! ],[1395118800000,21.63],[1395205200000,21.63],[1395291600000,21.83],[1395378000000,21.64],[1395637200000,21.57],[1395723600000,22.34],[1395810000000,22.32],[1395896400000,22.02],[1395982800000,22.33],[1396242000000,22.415],[1396328400000,23.1],[1396414800000,22.99],[1396501200000,23.09],[1396587600000,22.712],[1396846800000,22.85],[1396933200000,22.94],[1397019600000,23.12],[1397106000000,22.65],[1397192400000,22.46],[1397451600000,22.85],[1397538000000,22.89],[1397624400000,23.03],[1397710800000,23.21],[1398056400000,23.4],[1398142800000,23.52],[1398229200000,23.5],[1398315600000,23.33],[1398402000000,23],[1398661200000,23.02],[1398747600000,23.16],[1398834000000,23.11],[1398920400000,23.01],[1399006800000,22.94],[1399266000000,22.955],[1399352400000,22.72],[1399438800000,22.87],[1399525200000,23.018],[1399611600000,23.02],[1399870800000,23.19],[1399957200000,22.86],[1400043600000,22.81],[1400130000000,24.18],[1400216400000,24.37],[1400475600000,24.35],[1400562000000,24.12],[1400648400000,24.48],[1400734800000,24.38],[1400821200000,24.52],[1401166800000,24.71],[140125320

24.7 (1y: +1%) $(function(){var seriesOptions=[],yAxisOptions=[],name='CSCO',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1372654800000,24.335],[1372741200000,24.32],[1372827600000,24.59],[1373000400000,24.57],[1373259600000,24.625],[1373346000000,25.155],[1373432400000,25.41],[1373518800000,25.87],[1373605200000,25.94],[1373864400000,25.93],[1373950800000,25.71],[1374037200000,25.72],[1374123600000,25.86],[1374210000000,25.82],[1374469200000,25.72],[1374555600000,25.56],[1374642000000,25.59],[1374728400000,25.5],[1374814800000,25.496],[1375074000000,25.33],[1375160400000,25.67],[1375246800000,25.59],[1375333200000,25.891],[1375419600000,26.19],[1375678800000,26.31],[1375765200000,26.21],[1375851600000,26.12],[1375938000000,26.26],[1376024400000,26.053],[1376283600000,26.34],[1376370000000,26.321],[1376456400000,26.377],[1376542800000,24.485],[1376629200000,24.27],[1376888400000,24.27],[1376974800000,24.32],[1377061200000,24.07],[1377147600000,24.01],[1377234000000,23.86],[1377493200000,23.83],[1377579600000,23.485],[1377666000000,23.445],[1377752400000,23.45],[1377838800000,23.31],[1378184400000,23.48],[1378270800000,23.77],[1378357200000,23.69],[1378443600000,23.55],[1378702800000,23.92],[1378789200000,24.155],[1378875600000,24.375],[1378962000000,24.29],[1379048400000,24.32],[1379307600000,24.38],[1379394000000,24.37],[1379480400000,24.795],[1379566800000,24.615],[1379653200000,24.51],[1379912400000,24.275],[1379998800000,24.14],[1380085200000,24.43],[1380171600000,23.77],[1380258000000,23.33],[1380517200000,23.431],[1380603600000,23.24],[1380690000000,23.32],[1380776400000,23.005],[1380862800000,23.02],[1381122000000,22.89],[1381208400000,22.635],[1381294800000,22.5],[1381381200000,23.01],[1381467600000,23.28],[1381726800000,23.34],[1381813200000,23.18],[1381899600000,22.995],[1381986000000,22.781],[1382072400000,22.961],[1382331600000,22.93],[1382418000000,22.65],[1382504400000,22.255],[1382590800000,22.375],[1382677200000,22.455],[1382936400000,22.55],[1383022800000,22.825],[1383109200000,! 22.705],[1383195600000,22.56],[1383282000000,22.565],[1383544800000,22.58],[1383631200000,23.065],[1383717600000,23.28],[1383804000000,23.11],[1383890400000,23.51],[1384149600000,23.445],[1384236000000,23.73],[1384322400000,23.995],[1384408800000,21.365],[1384495200000,21.535],[1384754400000,21.29],[1384840800000,21.42],[1384927200000,21.23],[1385013600000,21.47],[1385100000000,21.46],[1385359200000,21.27],[1385445600000,21.21],[1385532000000,21.27],[1385704800000,21.25],[1385964000000,21.09],[1386050400000,21.26],[1386136800000,21.249],[1386223200000,20.91],[1386309600000,21.28],[1386568800000,21.22],[1386655200000,21.21],[1386741600000,20.88],[1386828000000,20.51],[1386914400000,20.24],[1387173600000,20.68],[1387260000000,20.92],[1387346400000,21],[1387432800000,21.07],[1387519200000,21.13],[1387778400000,21.57],[1387864800000,21.69],[1388037600000,21.8],[1388124000000,22.02],[1388383200000,22.25],[1388469600000,22.43],[1388642400000,22],[1388728800000,21.98],[1388988000000,22.01],[1389074400000,22.31],[1389160800000,22.293],[1389247200000,22.09],[1389333600000,22.22],[1389592800000,22.19],[1389679200000,22.41],[1389765600000,22.78],[1389852000000,22.78],[1389938400000,22.74],[1390284000000,22.83],[1390370400000,22.84],[1390456800000,22.56],[1390543200000,22.2],[1390802400000,22],[1390888800000,21.75],[1390975200000,21.65],[1391061600000,21.976],[1391148000000,21.91],[1391407200000,21.55],[1391493600000,21.8],[1391580000000,21.98],[1391666400000,22.49],[1391752800000,22.67],[1392012000000,22.83],[1392098400000,22.71],[1392184800000,22.85],[1392271200000,22.27],[1392357600000,22.56],[1392703200000,22.41],[1392789600000,22.28],[1392876000000,22.3],[1392962400000,22.13],[1393221600000,22.12],[1393308000000,21.84],[1393394400000,21.93],[1393480800000,21.92],[1393567200000,21.8],[1393826400000,21.57],[1393912800000,21.82],[1393999200000,21.87],[1394085600000,21.82],[1394172000000,21.73],[1394427600000,21.69],[1394514000000,21.61],[1394600400000,21.82],[1394686800000,21.52],[1394773200000,21.35],[1395032400! 000,21.51! ],[1395118800000,21.63],[1395205200000,21.63],[1395291600000,21.83],[1395378000000,21.64],[1395637200000,21.57],[1395723600000,22.34],[1395810000000,22.32],[1395896400000,22.02],[1395982800000,22.33],[1396242000000,22.415],[1396328400000,23.1],[1396414800000,22.99],[1396501200000,23.09],[1396587600000,22.712],[1396846800000,22.85],[1396933200000,22.94],[1397019600000,23.12],[1397106000000,22.65],[1397192400000,22.46],[1397451600000,22.85],[1397538000000,22.89],[1397624400000,23.03],[1397710800000,23.21],[1398056400000,23.4],[1398142800000,23.52],[1398229200000,23.5],[1398315600000,23.33],[1398402000000,23],[1398661200000,23.02],[1398747600000,23.16],[1398834000000,23.11],[1398920400000,23.01],[1399006800000,22.94],[1399266000000,22.955],[1399352400000,22.72],[1399438800000,22.87],[1399525200000,23.018],[1399611600000,23.02],[1399870800000,23.19],[1399957200000,22.86],[1400043600000,22.81],[1400130000000,24.18],[1400216400000,24.37],[1400475600000,24.35],[1400562000000,24.12],[1400648400000,24.48],[1400734800000,24.38],[1400821200000,24.52],[1401166800000,24.71],[140125320

Bloomberg News

Bloomberg News  Tatan Syuflana/APPacks of cigarettes displaying graphic health warnings at a convenience store in Jakarta, Indonesia. JAKARTA, Indonesia -- Indonesia became the newest country to mandate graphic photo warnings on cigarette packs Tuesday, joining more than 40 other nations or territories that have adopted similar regulations in recent years. The warnings, which showcase gruesome close-up images ranging from rotting teeth and cancerous lungs to open tracheotomy holes and corpses, are an effort to highlight the risks of health problems related to smoking. Research suggests these images have prompted people to quit, but the World Health Organization estimates nearly 6 million people continue to die globally each year from smoking-related causes. The tobacco industry has fought government efforts to introduce or increase the size of graphic warnings in some countries. Here are a few places where pictorial health warnings have made headlines: United States: The Law: No graphic pictures on packs. Timing: The government stepped away from a legal battle with tobacco companies in March 2013. Background: There are currently no pictorial warnings on cigarette packs in the U.S. After the tobacco industry sued, a Food and Drug Administration order to include the graphic labels was blocked last year by an appeals court, which ruled that the photos violated First Amendment free speech protections. The government opted not to take the case to the U.S. Supreme Court, but will instead develop new warnings. About 18 percent of adult Americans smoke. Indonesia: The Law: 40 percent of pack covered by graphic photos. Timing: Deadline to be on shelves was June 24. Background: Many tobacco companies missed Tuesday's deadline to comply with the new law requiring all cigarette packs in stores to carry graphic warning photos. Indonesia, a country of around 240 million, has the world's highest rate of male smokers at 67 percent and the second-highest rate overall. Its government is among the few that has yet to sign a World Health Organization treaty on tobacco control. Thailand: The Law: Portion of cigarette packs that must be covered with graphic health warnings rising from 55 percent to 85 percent. Timing: Change will take effect in September. Background: Last year, the Public Health Ministry issued a regulation increasing the level of coverage to 85 percent. Tobacco giant Philip Morris and more than 1,400 Thai retailers sued, and a court temporarily suspended the order. On Friday, the Supreme Administrative Court ruled that the regulation can take effect. Australia: The Law: No cigarette brand logos permitted; graphic health warnings required on 75 percent of front and 90 percent of back. Timing: Plain packaging law went into effect in 2012. Background: Australia became the first country in the world to mandate plain cigarette packs with no brand logo or colors permitted. Instead, the packs are solid brown and covered in large graphic warnings. Tobacco companies fought The Law, saying it violated intellectual property rights and devalued their trademarks, but the country's highest court upheld it. Figures released this month by the country's Bureau of Statistics found that cigarette consumption fell about 5 percent from March 2013 to the same period this year. The World Trade Organization has agreed to hear complaints filed by several tobacco-growing countries, but other governments have expressed interest in passing similar laws. Smokers make up 17 percent of Australia's population. Philippines: The Law: Graphic warning legislation approved this month requires 50 percent of bottom of the pack to be covered by graphic warnings. Timing: Legislation awaits president's signature. Background: The Philippines is expected to join a handful of other countries that put graphic warnings at the bottom of their packs, meaning they are not visible when displayed on store shelves. Anti-smoking advocates say labels on the bottom of the packs are less effective, and have denounced tobacco industry involvement in the implementation process. Health officials said around 17 million people in the country of 96 million, or 18 percent, smoked in 2012. Uruguay: The Law: Graphic warnings cover 80 percent of packs. Timing: Regulations implemented in 2010.

Tatan Syuflana/APPacks of cigarettes displaying graphic health warnings at a convenience store in Jakarta, Indonesia. JAKARTA, Indonesia -- Indonesia became the newest country to mandate graphic photo warnings on cigarette packs Tuesday, joining more than 40 other nations or territories that have adopted similar regulations in recent years. The warnings, which showcase gruesome close-up images ranging from rotting teeth and cancerous lungs to open tracheotomy holes and corpses, are an effort to highlight the risks of health problems related to smoking. Research suggests these images have prompted people to quit, but the World Health Organization estimates nearly 6 million people continue to die globally each year from smoking-related causes. The tobacco industry has fought government efforts to introduce or increase the size of graphic warnings in some countries. Here are a few places where pictorial health warnings have made headlines: United States: The Law: No graphic pictures on packs. Timing: The government stepped away from a legal battle with tobacco companies in March 2013. Background: There are currently no pictorial warnings on cigarette packs in the U.S. After the tobacco industry sued, a Food and Drug Administration order to include the graphic labels was blocked last year by an appeals court, which ruled that the photos violated First Amendment free speech protections. The government opted not to take the case to the U.S. Supreme Court, but will instead develop new warnings. About 18 percent of adult Americans smoke. Indonesia: The Law: 40 percent of pack covered by graphic photos. Timing: Deadline to be on shelves was June 24. Background: Many tobacco companies missed Tuesday's deadline to comply with the new law requiring all cigarette packs in stores to carry graphic warning photos. Indonesia, a country of around 240 million, has the world's highest rate of male smokers at 67 percent and the second-highest rate overall. Its government is among the few that has yet to sign a World Health Organization treaty on tobacco control. Thailand: The Law: Portion of cigarette packs that must be covered with graphic health warnings rising from 55 percent to 85 percent. Timing: Change will take effect in September. Background: Last year, the Public Health Ministry issued a regulation increasing the level of coverage to 85 percent. Tobacco giant Philip Morris and more than 1,400 Thai retailers sued, and a court temporarily suspended the order. On Friday, the Supreme Administrative Court ruled that the regulation can take effect. Australia: The Law: No cigarette brand logos permitted; graphic health warnings required on 75 percent of front and 90 percent of back. Timing: Plain packaging law went into effect in 2012. Background: Australia became the first country in the world to mandate plain cigarette packs with no brand logo or colors permitted. Instead, the packs are solid brown and covered in large graphic warnings. Tobacco companies fought The Law, saying it violated intellectual property rights and devalued their trademarks, but the country's highest court upheld it. Figures released this month by the country's Bureau of Statistics found that cigarette consumption fell about 5 percent from March 2013 to the same period this year. The World Trade Organization has agreed to hear complaints filed by several tobacco-growing countries, but other governments have expressed interest in passing similar laws. Smokers make up 17 percent of Australia's population. Philippines: The Law: Graphic warning legislation approved this month requires 50 percent of bottom of the pack to be covered by graphic warnings. Timing: Legislation awaits president's signature. Background: The Philippines is expected to join a handful of other countries that put graphic warnings at the bottom of their packs, meaning they are not visible when displayed on store shelves. Anti-smoking advocates say labels on the bottom of the packs are less effective, and have denounced tobacco industry involvement in the implementation process. Health officials said around 17 million people in the country of 96 million, or 18 percent, smoked in 2012. Uruguay: The Law: Graphic warnings cover 80 percent of packs. Timing: Regulations implemented in 2010.

Bloomberg News

Bloomberg News  Utah Highway Patrol/AP NEW YORK -- A U.S. judge signed off on Toyota Motor's (TM) $1.2 billion settlement of criminal charges that it concealed safety problems in its vehicles, an accord that could serve as a model for a similar probe into General Motors (GM). U.S. District Judge William Pauley approved the Japanese automaker's deferred prosecution agreement at a hearing Thursday in Manhattan. His approval came one day after the U.S. Department of Justice said it resolved its investigation into problems that caused Toyota vehicles to accelerate suddenly. Pauley said the case presented a "reprehensible picture of corporate misconduct," and expressed hope that the government would ultimately hold the responsible decisionmakers at Toyota accountable. "This unfortunately is a case that demonstrates that corporate fraud can kill," he said. Pauley ruled shortly after Christopher Reynolds, Toyota's North American legal chief, entered a "not guilty" plea on behalf of the automaker to one count of wire fraud. The $1.2 billion settlement is the largest such penalty ever levied by the United States on an auto company. It resolves issues that have dogged Toyota since at least 2007 and have been linked to at least five deaths. Toyota still faces hundreds of private lawsuits. The settlement marked a huge victory for safety advocates who fought for years for criminal prosecution of automakers over safety violations. Toyota agreed to a so-called statement of facts, in which it admitted to having misled U.S. consumers and a federal regulator about two problems that caused cars to accelerate even if drivers tried to slow them down. No guilty plea was required, and the government agreed not to prosecute Toyota for wire fraud for three years. The charge will be dismissed in 2017 if Toyota follows the terms of the accord, which include allowing an independent monitor to review its safety practices. A spokeswoman for Toyota declined to comment, as did a spokeswoman for U.S. Attorney Preet Bharara in Manhattan. U.S. authorities are investigating GM over its handling of an ignition switch defect linked to 12 deaths, and which resulted in a recall last month of more than 1.6 million vehicles, mostly in the United States. Attorney General Eric Holder told reporters Wednesday that he hoped the Toyota deal would "serve as a model for how to approach future cases involving similarly situated companies." The Toyota investigation flowed out of publicity starting in 2009 over unintended acceleration linked to at least five deaths, and which prompted hundreds of lawsuits. Last year, a federal judge approved a settlement valued at $1.6 billion to resolve claims by Toyota owners that the value of their cars dropped because of the negative publicity. The case is U.S. v. Toyota Motor Corp., U.S. District Court, Southern District of New York, No. 14-cr-00186.

Utah Highway Patrol/AP NEW YORK -- A U.S. judge signed off on Toyota Motor's (TM) $1.2 billion settlement of criminal charges that it concealed safety problems in its vehicles, an accord that could serve as a model for a similar probe into General Motors (GM). U.S. District Judge William Pauley approved the Japanese automaker's deferred prosecution agreement at a hearing Thursday in Manhattan. His approval came one day after the U.S. Department of Justice said it resolved its investigation into problems that caused Toyota vehicles to accelerate suddenly. Pauley said the case presented a "reprehensible picture of corporate misconduct," and expressed hope that the government would ultimately hold the responsible decisionmakers at Toyota accountable. "This unfortunately is a case that demonstrates that corporate fraud can kill," he said. Pauley ruled shortly after Christopher Reynolds, Toyota's North American legal chief, entered a "not guilty" plea on behalf of the automaker to one count of wire fraud. The $1.2 billion settlement is the largest such penalty ever levied by the United States on an auto company. It resolves issues that have dogged Toyota since at least 2007 and have been linked to at least five deaths. Toyota still faces hundreds of private lawsuits. The settlement marked a huge victory for safety advocates who fought for years for criminal prosecution of automakers over safety violations. Toyota agreed to a so-called statement of facts, in which it admitted to having misled U.S. consumers and a federal regulator about two problems that caused cars to accelerate even if drivers tried to slow them down. No guilty plea was required, and the government agreed not to prosecute Toyota for wire fraud for three years. The charge will be dismissed in 2017 if Toyota follows the terms of the accord, which include allowing an independent monitor to review its safety practices. A spokeswoman for Toyota declined to comment, as did a spokeswoman for U.S. Attorney Preet Bharara in Manhattan. U.S. authorities are investigating GM over its handling of an ignition switch defect linked to 12 deaths, and which resulted in a recall last month of more than 1.6 million vehicles, mostly in the United States. Attorney General Eric Holder told reporters Wednesday that he hoped the Toyota deal would "serve as a model for how to approach future cases involving similarly situated companies." The Toyota investigation flowed out of publicity starting in 2009 over unintended acceleration linked to at least five deaths, and which prompted hundreds of lawsuits. Last year, a federal judge approved a settlement valued at $1.6 billion to resolve claims by Toyota owners that the value of their cars dropped because of the negative publicity. The case is U.S. v. Toyota Motor Corp., U.S. District Court, Southern District of New York, No. 14-cr-00186. Patrick T. Fallon/Bloomberg via Getty Images Staples (SPLS), the largest office-supplies chain, will close as many as 225 stores in North America and reduce costs by as much as $500 million by the end of 2015, as it forecast sales to drop for a fifth consecutive quarter. The savings are expected to come from supply chain, retail store closures and measures including "labor optimization, non-product related costs, IT hardware and services, marketing, sales force and customer service," the Framingham, Mass.-based company said in a statement Thursday. Staples is facing increased competition from online retailers including Amazon.com (AMZN). Revenue in its fiscal first quarter will fall from a year earlier, excluding any potential impact from its restructuring plan, the retailer said Thursday without providing a projection. Shares fell 15 percent to $11.35 at 11:08 a.m. in New York and earlier dropped as much as 17 percent for the biggest intraday decline since Aug. 15, 2012. The stock slid 16 percent this year through yesterday, compared with a 1.4 percent gain for the Standard & Poor's 500 index (^GPSC) . "With nearly half of our sales generated online Thursday, we're meeting the changing needs of business customers and taking aggressive action to reduce costs and improve efficiency," Chief Executive Officer Ron Sargent said in the statement. The company expects earnings of 17 cents to 22 cents a share for the first quarter. That compares with the average analyst estimate of 27 cents on an adjusted basis, according to data compiled by Bloomberg. Analysts on average estimate the retailer to post revenue of $5.74 billion in the quarter, compared with $5.81 billion a year earlier. Kirk Saville, a spokesman for Staples, didn't immediately respond to voicemails and an e-mail seeking comment on how many jobs will be eliminated by the cost-cutting plan Staples joins RadioShack (RSH), the electronics retailer, in trying to overhaul its business by closing stores in the face of increasing competition from e-commerce rivals. The company announced plans March 4 to close about a fifth of its stores after fourth-quarter sales missed estimates. Staples shuttered 42 stores in North America last year, ending 2013 with 1,846 in the region. The company reported fourth quarter income from continuing operations of $212 million, or 33 cents a share, compared to $90 million, or 14 cents a share, a year earlier. the world's largest office-supplies chain, plans to shutter as many as 225 stores in North America and cut costs by as much $500 million by the end of 2015, as it forecast a first-quarter sales decline. The savings are expected to come from supply chain, retail store closures and measures including "labor optimization, non-product related costs, IT hardware and services, marketing, sales force and customer service," the Framingham, Mass.-based company said in a statement Thursday.

Patrick T. Fallon/Bloomberg via Getty Images Staples (SPLS), the largest office-supplies chain, will close as many as 225 stores in North America and reduce costs by as much as $500 million by the end of 2015, as it forecast sales to drop for a fifth consecutive quarter. The savings are expected to come from supply chain, retail store closures and measures including "labor optimization, non-product related costs, IT hardware and services, marketing, sales force and customer service," the Framingham, Mass.-based company said in a statement Thursday. Staples is facing increased competition from online retailers including Amazon.com (AMZN). Revenue in its fiscal first quarter will fall from a year earlier, excluding any potential impact from its restructuring plan, the retailer said Thursday without providing a projection. Shares fell 15 percent to $11.35 at 11:08 a.m. in New York and earlier dropped as much as 17 percent for the biggest intraday decline since Aug. 15, 2012. The stock slid 16 percent this year through yesterday, compared with a 1.4 percent gain for the Standard & Poor's 500 index (^GPSC) . "With nearly half of our sales generated online Thursday, we're meeting the changing needs of business customers and taking aggressive action to reduce costs and improve efficiency," Chief Executive Officer Ron Sargent said in the statement. The company expects earnings of 17 cents to 22 cents a share for the first quarter. That compares with the average analyst estimate of 27 cents on an adjusted basis, according to data compiled by Bloomberg. Analysts on average estimate the retailer to post revenue of $5.74 billion in the quarter, compared with $5.81 billion a year earlier. Kirk Saville, a spokesman for Staples, didn't immediately respond to voicemails and an e-mail seeking comment on how many jobs will be eliminated by the cost-cutting plan Staples joins RadioShack (RSH), the electronics retailer, in trying to overhaul its business by closing stores in the face of increasing competition from e-commerce rivals. The company announced plans March 4 to close about a fifth of its stores after fourth-quarter sales missed estimates. Staples shuttered 42 stores in North America last year, ending 2013 with 1,846 in the region. The company reported fourth quarter income from continuing operations of $212 million, or 33 cents a share, compared to $90 million, or 14 cents a share, a year earlier. the world's largest office-supplies chain, plans to shutter as many as 225 stores in North America and cut costs by as much $500 million by the end of 2015, as it forecast a first-quarter sales decline. The savings are expected to come from supply chain, retail store closures and measures including "labor optimization, non-product related costs, IT hardware and services, marketing, sales force and customer service," the Framingham, Mass.-based company said in a statement Thursday.

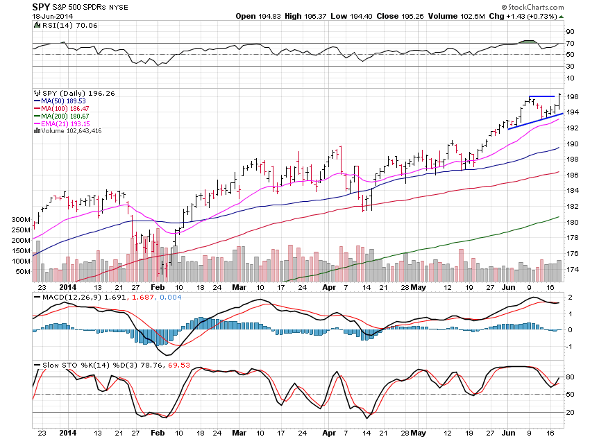

SPY is now breaking out of the wedge pattern and off to the races. Nice volume pushed it to the breakout point which is what I always like to see.

SPY is now breaking out of the wedge pattern and off to the races. Nice volume pushed it to the breakout point which is what I always like to see. Michael Sohn/AP The smartwatch craze appears to have come and gone without changing the world. Pebble -- the Kickstarter-funded company the kicked off the revolution of Web-tethered wristwatches -- has been a fringe player at best. Samsung (SSNLF) -- the world's largest maker of smartphones -- hasn't had a lot of success with its Galaxy Gear line, now in its second incarnation. Silent through this ho-hum movement is Apple (AAPL), the one company that many figured would be the game changer in this once-promising niche of wearable computing. There was some hope that Apple would use its Worldwide Developers Conference earlier this month to announce its entry into the smartwatch market and woo top developers to start coding applications for the iWatch. It didn't happen. However, shortly after the conference closed, reports began to surface about Apple entering the market in October. This will be a big story if it happens, but it may be too late. Rock Around the Clock The smartwatch was supposed to change everything. Pebble's initial shortcomings -- it didn't make calls and ran only a limited number of apps -- seemed to have been addressed when Samsung and Qualcomm (QCOM) introduced fancier fare. However, with Samsung limiting its devices to work only with select Galaxy devices and Qualcomm's Toq coming up short due to a lack of voice commands and native input options, we find ourselves with a revolution that appears stuck in the mud. Apple could change that, but the world's leading consumer tech company faces an uphill battle to overcome obstacles that have soured the market's enthusiasm for timepieces with computing features. Time is Ticking Away Apple investors are hungry for innovation in a new product category. Mac sales have stalled; the iPod has been declining in popularity for a couple of years; and even the iPad saw a surprising drop in sales in the latest quarter. The iPhone continues to be the workhorse for Apple, and a little diversification wouldn't hurt. Tim Cook could also use a defining new product. The Mac, iPod, iPhone and iPad all came to life under Steve Jobs. Cook is now closing in on three years as Apple's CEO, and investors will begin to turn on him if the tech bellwether doesn't have a new sales workhorse in place if and when the iPhone begins to fade. It's easy to fathom how the iWatch could be successful. Outdoor recreation enthusiasts could check navigation without having to fumble through their pockets for their smartphones. Activating Siri would be a breeze. Videoconferencing through FaceTime -- even on a small wristwatch screen -- seems like a natural idea. Apple could clearly raise the bar here. It's not the kind of company that shows up fashionably late to the party unless it's bringing something new to the table. But it's about more than just a single wrist-hugging gadget. The iWatch could help spark sales of iPads and iPhones if its features are tied exclusively to Apple's iOS platform, though that comes with a juicy caveat: Samsung got burned by making its Galaxy Gear too restrictive. However, if it's a hit, it will tie Apple fans closer to Apple's mobile operating system. You're not likely to switch to Android when your iPhone contract runs out or your iPad grows stale if you have recently invested in an iWatch. Apple will have to hope that it's not too late to get it right with the smartwatch. There's plenty at stake if it's successful, but time is running out for the smartwatch to matter in the marketplace. More from Rick Aristotle Munarriz

Michael Sohn/AP The smartwatch craze appears to have come and gone without changing the world. Pebble -- the Kickstarter-funded company the kicked off the revolution of Web-tethered wristwatches -- has been a fringe player at best. Samsung (SSNLF) -- the world's largest maker of smartphones -- hasn't had a lot of success with its Galaxy Gear line, now in its second incarnation. Silent through this ho-hum movement is Apple (AAPL), the one company that many figured would be the game changer in this once-promising niche of wearable computing. There was some hope that Apple would use its Worldwide Developers Conference earlier this month to announce its entry into the smartwatch market and woo top developers to start coding applications for the iWatch. It didn't happen. However, shortly after the conference closed, reports began to surface about Apple entering the market in October. This will be a big story if it happens, but it may be too late. Rock Around the Clock The smartwatch was supposed to change everything. Pebble's initial shortcomings -- it didn't make calls and ran only a limited number of apps -- seemed to have been addressed when Samsung and Qualcomm (QCOM) introduced fancier fare. However, with Samsung limiting its devices to work only with select Galaxy devices and Qualcomm's Toq coming up short due to a lack of voice commands and native input options, we find ourselves with a revolution that appears stuck in the mud. Apple could change that, but the world's leading consumer tech company faces an uphill battle to overcome obstacles that have soured the market's enthusiasm for timepieces with computing features. Time is Ticking Away Apple investors are hungry for innovation in a new product category. Mac sales have stalled; the iPod has been declining in popularity for a couple of years; and even the iPad saw a surprising drop in sales in the latest quarter. The iPhone continues to be the workhorse for Apple, and a little diversification wouldn't hurt. Tim Cook could also use a defining new product. The Mac, iPod, iPhone and iPad all came to life under Steve Jobs. Cook is now closing in on three years as Apple's CEO, and investors will begin to turn on him if the tech bellwether doesn't have a new sales workhorse in place if and when the iPhone begins to fade. It's easy to fathom how the iWatch could be successful. Outdoor recreation enthusiasts could check navigation without having to fumble through their pockets for their smartphones. Activating Siri would be a breeze. Videoconferencing through FaceTime -- even on a small wristwatch screen -- seems like a natural idea. Apple could clearly raise the bar here. It's not the kind of company that shows up fashionably late to the party unless it's bringing something new to the table. But it's about more than just a single wrist-hugging gadget. The iWatch could help spark sales of iPads and iPhones if its features are tied exclusively to Apple's iOS platform, though that comes with a juicy caveat: Samsung got burned by making its Galaxy Gear too restrictive. However, if it's a hit, it will tie Apple fans closer to Apple's mobile operating system. You're not likely to switch to Android when your iPhone contract runs out or your iPad grows stale if you have recently invested in an iWatch. Apple will have to hope that it's not too late to get it right with the smartwatch. There's plenty at stake if it's successful, but time is running out for the smartwatch to matter in the marketplace. More from Rick Aristotle Munarriz